TheFinanceWalk is a leading finance blog provider of financial market information, we strive to enable interested individuals by offering doors open to a wide range of career prospects in this dynamic sector, under the broad title “Finance Consumer Service Professional” We understand the importance of jobs and employment opportunities in the field of finance consumer services industry.

Is Finance Consumer Services a Good Career Path?

A career in finance consumer services can be an equally rewarding and promising path for individuals or professionals interested in the step into the financial industry. The Finance field offers opportunities to work directly with individuals, businesses, and institutions.

There are a wide variety of roles under the title “Finance Consumer Service“, however, most of those job titles involve providing others with essential financial guidance and support.

As a finance consumer services professional, you have regular engagement with clients to assist them in managing their budgets, improving their financial records, and making helping them make informed decisions about their funds and investments.

By assisting people to understand and navigate their financial hurdles and achieve desired results, you can make a direct yet meaningful impact on their everyday lives.

Moreover, the finance industry is constantly evolving and undergoing a regular transformation from the context of compliance from regulators, technology, product, and service offering. Thus regularly offers a wide range of job prospects and great potential for personal growth and career progression.

With the right amount of education, and skills, coupled with certifications & licenses, knowledge of wide market segments, and unshakeable dedication, a career in finance consumer services can to a very rewarding and successful finance professional journey.

The Growing Demand for Finance Consumer Services Professionals

How many Jobs are available in Finance Consumer Services?

With the ever-increasing complexity of the financial industry and news transformations happening almost every day, the demand for skilled professionals in the finance consumer services industry is ever-increasing.

As businesses diversify and add verticals to their list of services & products they provide, they need constant assistance to seek expert advice from industry domain experts to navigate their financial goals, the demand for informed and experienced finance consumer professionals has gone up.

Best Paying Jobs in Finance Consumer Services

Compliance Officer

Net average salary: $70,468

A vigilant compliance officer is responsible for guaranteeing the keep up with the company to pertinent laws, regulations, and internal policies. Their principal responsibilities are collective formulation, execution, and enforcement of compliance programs aimed at mitigating legal and regulatory troubles.

These individuals titled “Compliance Officers” remain well-informed regarding amendments made to laws and regulations and regularly carry out audits and risk assessments to pinpoint plausible compliance issues.

Moreover, they provide comprehensive training to employees regarding compliance policies and procedures, while diligently digging into and resolving instances of infractions or misconduct.

Financial Advisor

Net average salary: $81,776

Financial advisor, also known as a personal financial advisor, you have the opportunity to assist individuals and businesses in making sound financial decisions, situations may come across that you have to assist entities with some or no financial background.

From personal finance planning, and retirement planning to short-term, and long-term investment strategies, your knowledge, experience, and expertise will play an important role in helping clients achieve their financial goals or aspirations.

Loan Officer

Net average salary: $181,795

Loan associates and loan officers play a part in facilitating borrowing and loaning capital for individuals and businesses, they are more of the facilitators working with banks or private financial institutions, or even a combination of both.

By evaluating individual(s) or organization(s) creditworthiness, negotiating terms, and simplifying the compliance process, loan officers play an undeniably important role in supporting the financial growth and financial stability of the entity.

Insurance Agent/Broker

Net average salary: $59,483

As an insurance agent, you will educate individual(s), institution(s), and businesses about potential risks and safeguard them by providing or offering suitable or tailor-made insurance policies.

Your expertise may include but is not limited to evaluating potential risk factors, providing tailored coverage to their risks, and assisting clients (individuals as well as businesses) during claim settlements, this way your knowledge, expertise, and assistance to them will be invaluable in safeguarding their financial well-being.

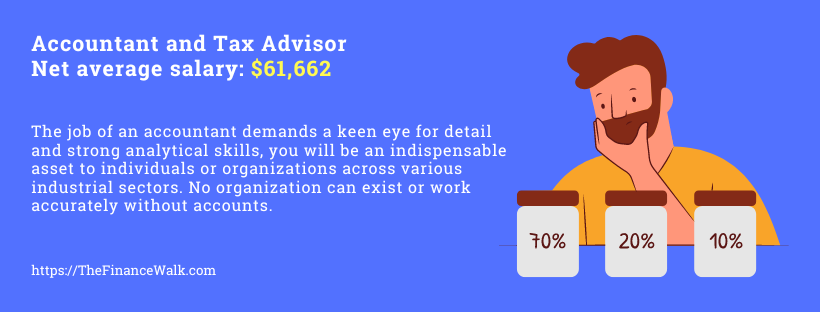

Accountant and Tax Advisor

Net average salary: $61,662

When it comes to record-keeping, bookkeeping, balance sheets, annual tax filing, etc. Everyone rushes to accountants. Accountants play a crucial and very important role in maintaining financial records and analyzing financial data, which comprises of sells, purchases, employee salaries, and miscellaneous expenses, to maintain compliance with government and legal authorities.

The job of an accountant demands a keen eye for detail and strong analytical skills, you will be an indispensable asset to individuals or organizations across various industrial sectors. No organization can exist or work accurately without accounts.

Financial Analyst

Net average salary: $74,689

Just like financial advisors, loan officers, insurance agents, and accounts experts, the financial analyst would also be the sub-set finance consumer service.

As a financial analyst, you will provide accurate insightful analysis (fundamental and technical), and recommendations to guide investment and hedge fund managers, to reach an investment decision.

Your expertise may include evaluating market trends, individual & institutional financial statements, understanding institutional promoters’ holdings, organizational future plans, industry trends, currency markets, real estate, stock market, and commodities.

The risk assessments and mitigation for the above-mentioned industries will be an important yet everyday job in driving business growth and profitability.

Qualifications and Skills Required

To excel in the field of finance consumer services industry, you may require certain qualifications, skills, prerequisites, and specialized certification from the finance domain is highly desirable.

Educational Background – Finance Consumer Services

A bachelor’s degree in finance, economics, accounting, or a related field will provide a solid groundwork to successfully start a career in finance consumer services. You may need to undergo advanced certifications, such as

- The Association of Chartered Certified Accountants (ACCA)

- Certified Public Accountants (CPA)

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP),

The above qualification can further enrich your expertise and credibility. In recent years it has been observed that more and more students and professionals from engineering backgrounds are also now getting into the field of Finance and Consumer Services.

Strong Analytical Skills

The extensive ability to interpret complex financial market data, perform quantitative and qualitative assessments of the data available, and draw meaningful insights from that data is crucial in finance consumer services.

Proficiency in specialized financial software, tools & techniques will also greatly enhance your analytical capabilities.

Effective Communication – Key Ingredient

As a finance professional, you may need to talk to people from a wide industrial segment and thus, you must essentially possess excellent communication skills in the desired language or the language of your choice based on your geographic location.

This ability to communicate will help you to clearly convey complex financial concepts and your understanding of the finance world to clients and colleagues. Strong interpersonal skills are desirable for building mutual trust and maintaining lasting relationships with clients personally and officially.

Ethics and Integrity drives Finance Consumer Services Industry

As they say, Jack of All and King of None, definitely won’t work in your favor when it comes to the world of finance consumer service. Organizations rise and fall on a daily basis in the Finance industry.

Upholding the highest ethical and organizational standards is pre-eminent and foremost in the finance consumer services industry.

Clients delegate their financial well-being to finance professionals like you, and maintaining their unshakeable trust through organizational standards and ethical conduct is of utmost importance. Remember, trust climbs stairs and broken trust jumps out of the window.

Finance Industry Trends and Future Outlook

The finance consumer services industry is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer demands. Staying updated with industry trends and embracing innovation will be key to remaining competitive in the years to come.

Digital Transformation

There were times when consumers would know about Financial organizations, their products, and their services only through advertisements in print media.

It was a tedious and time-consuming process for both consumers and service providers. However, the massive development in High-Tech changed the face of almost all industrial segments.

The transformation also touched the Finance industry which is experiencing a significant digital transformation, with the evergrowing of fintech companies and online financial services.

Finance professionals with a thorough and deep understanding of digital platforms and new innovative technologies will be in high demand.

Sustainable Finance Consumer Services

The awareness and growing focus on the micro level, sustainability, and responsible investing have led to the new verticle titled sustainable finance. Now professionals with knowledge and expertise in the fields of environmental, social-economic, and governance (ESG) factors will contribute an important role in shaping the near future of finance consumer services.

Join Us in Shaping the Future of Finance Consumer Services

At TheFinanceWalk, we are committed to fostering a real-time, dynamic, and inclusive informative environment that empowers individuals and businesses to thrive in the finance consumer services industry.

We understand the criticality of continuous learning and offer extensive data information and develop blog articles to support your personal and professional growth in the world of Finance.

Customer Success in the finance industry depends on his/her knowledge of Finance or getting hold of a finance consumer service expert.

However, the ability to reach out to the right financial advisor depends not only on the customer but on the ability of the finance consumer service experts ability to convey correct and adequate information to the consumer at the right time.

Thus, its important to consider factors such as finance qualifications, and areas of expertise & interest. Whether consumers require stand-alone or comprehensive solutions, or tailored financial planning, investment advice, tax guidance, or estate planning assistance, there is a financial advisor out there who can help them make sound financial decisions and work toward their financial objectives.

This could be you, and your client could be any individual or even a multi-national billion-dollar organization, or maybe not all depends on you.

FQA – Finance Consumer Services

Q1: How much do finance jobs pay or compensate?

A: Salaries within the finance industry can vary based on a multitude of factors such as job function, level of experience, geographical location, and organizational size. In general, finance jobs offer competitive compensation packages, with certain positions ranking among the highest-paid in the corporate realm. Occupations such as investment bankers, financial analysts, and senior executives often command substantial salaries, whereas entry-level roles may feature more modest starting pay.

Q2: What companies are in the finance field?

A: The finance sector encompasses a wide array of companies and institutions. Examples of entities in the finance field include banks, investment firms, insurance providers, accounting organizations, credit unions, mortgage companies, and financial technology (fintech) enterprises. Furthermore, many businesses spanning various industries maintain finance departments or employ finance professionals to oversee their financial operations.

Q3: How many Jobs are available in Finance Field?

A: The quantity of employment opportunities in the finance industry fluctuates in response to economic conditions, industry trends, and geographic location. Finance represents a broad domain with a diverse range of job prospects. Although providing an exact figure is challenging, the finance sector generally presents a substantial number of job openings, spanning from entry-level positions to senior executive roles.

Q4: What exactly is Finance Consumer Services?

A: Finance consumer services pertain to the delivery of financial guidance, assistance, and solutions to individuals, businesses, and institutions. Professionals engaged in finance consumer services collaborate with clients to manage their financial affairs, devise budgets, devise investment strategies, plan for retirement, address insurance needs, and tackle various other financial aspects. Their objective is to empower clients to make well-informed decisions regarding their financial resources and investments, thereby enhancing their overall financial well-being.

Q5: How many employment opportunities exist in Finance Consumer Services?

A: The demand for proficient professionals in finance consumer services has been on the rise ever since. As businesses and individuals seek expert financial advice to understand their financial objectives, there is a need for knowledgeable and seasoned finance consumer services professionals. While providing an exact figure proves challenging, the field presents numerous employment prospects for individuals keen on offering financial guidance and support to clients.